How To Deploy COVID-19 Relief with Equity in Mind

By Rudy Espinoza and Marco Covarrubias

We are not doing enough to make sure that public resources are reaching small businesses in our country.

This morning, the County of Los Angeles promoted yet another program to help small businesses survive the COVID-19 Crisis: the “Save Small Business” Fund. Last week, the Small Business Administration (SBA) announced that the Paycheck Protection Program (PPP) had run out of money after two frenzied weeks where small businesses across the country scrambled to submit applications and banks scrambled to process loans. Here in LA, the County of Los Angeles’ own version of a small business relief program shut down in less than one hour, after receiving thousands of applications.

All of these programs ran out of money faster than most concert tickets do. But besides the obvious need for federal, state, and local governments to pump more money into supporting small businesses, we find ourselves thinking: In a climate of tremendous need where small business owners are struggling to survive long enough for shelter in place orders to be safely lifted, what can we do to ensure the programs we design to save small businesses actually reach those with the most need?

We know all too well that the well-connected are the first in line to receive support in an emergency. At the start of the COVID-19 pandemic, Congress acted quickly to bail out Wall Street while working class people were left with one-time $1200 checks. The PPP was generally praised as a reasonable assist to small businesses, offering to forgive debt incurred if at least 75% is used to support the payroll of a business’ workers. Although the resources available were not sufficient to meet the need, the concept was a good one.

Unfortunately, the concept of a good program is not enough, we must also consider the methods we use to ensure that the program reaches those most vulnerable during a catastrophe like COVID-19. The “First-Come First Served” model of relief delivery favors well-connected, wealthier businesses who have the resources to quickly apply for relief. Over the weekend, we began hearing reports that major chains like Ruth’s Chris Steakhouse were receiving massive payouts through the PPP program, and just today, we are learning that some financial institutions were not just prioritizing their existing clientele, they may have also been shuffling the deck.

The Treasury’s report on PPP loans approved to date shows us that almost half of all PPP loans went to “small” businesses with loans of $1 million or higher and that 44% of PPP dollars went to only 4% of applicants. Since the loan sizes represent about 2.5 months of payroll, these loan sizes show us that these businesses may not be as small as one might think.

Here in LA, even the PPP resources facilitated by local agencies hit a snag, as websites were overloaded immediately. All of us heard stories of small businesses being left out, facing frozen screens, and spending hours refreshing pages in hopes that they’ll have an opportunity to make a case for support.

Our country has not prioritized the needs of small businesses and working families. There simply isn’t enough money being allocated to them. But, the resources that are approved must be delivered in a way that maximizes the potential that they get into the hands of people that really need it, not large, privately owned corporations. Here are some thoughts on how to improve the process of delivering resources to small business and families most in need:

Democratize Information - The Inclusive Action team helped a few businesses access LA County’s application for PPP loans, through CRF, but we found it challenging to support immigrant entrepreneurs who may not have all their paperwork ready at a moment’s notice to apply for a federal loan. To make the process easier, loan and grant portals should share what information they will be requesting BEFORE an opportunity is promoted. Instead of “dropping the link” a few hours prior to its opening, entrepreneurs and the community organizations should be given at least a day or two to get ready. It’s difficult to drop everything to respond to the latest resource.

Clarify who is eligible, and who is not - Applying for anything, whether a job, a loan, or a grant, can be tricky if the receiver of the application is not clear on what they are looking for. For the PPP loan, businesses under 500 employees were eligible, and even some that had more employees could qualify if they met certain criteria. As we are seeing more and more small businesses being left out, we should be clearer about who we are trying to reach. Should we lower the threshold to businesses with under 200 employees? Should there be specific payroll thresholds that an applicant cannot go over? Should the program be focused on businesses in neighborhoods that have historically been redlined? Clarifying who we’re trying to reach can help us ensure that resources go to those most in need.

Engage community-based leaders to distribute information - With the roll out of PPP, we saw many lenders focus on supporting their existing clients. We understand this approach, focusing on your existing network facilitates speedy deployment of resources which has been a primary goal of many resources. BUT, many small businesses that do not have a strong relationship with their bank were left out. To support a more equitable delivery of resources, we should engage community-based organizations and leaders to promote offerings, and where appropriate, even help people organize their information for their application. We used this approach in our Street Vendor Emergency Fund: we knew we couldn’t simply open up our application to the public, so we relied on street vendor leaders to promote the opportunity in their network first.

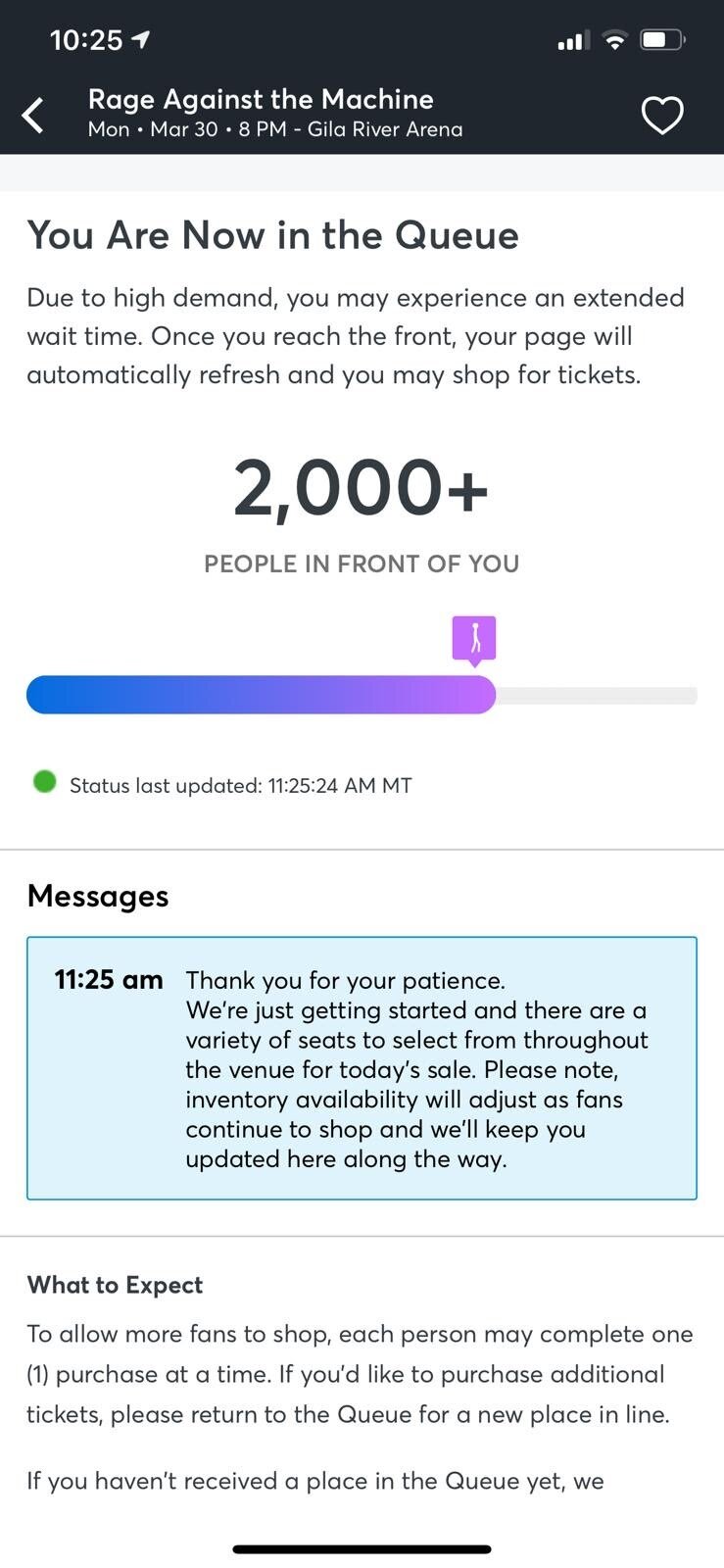

Establish a “queue” system for online applications - Many small business owners have experienced the almost immediate crash of loan and grant portals online. The fact is that there are simply too many people trying to access limited resources and it is overwhelming servers. Some reports described thousands of people attempting to access the Angeleno Card from outside of the state that was strictly for LA residents. This deluge of applicants crashed the system and left many eligible people frustrated in front of their screens. We should consider investing in new systems that avoid this where possible. The “easy” solution would be to invest in more servers before a resource is made available, but publicly managed online portals managed by government entities can also take a cue from companies like Ticketmaster. A few months ago, we logged in to buy concert tickets for a show that was expected to sell out in 30 minutes. We didn’t get into the portal immediately, but the website assured us that we were in the queue. It even told us how many people were in front of us. Can we do the same for publicly available resources?

Not all relief efforts taking place are bad. While we are hearing that some financial institutions are proving themselves to be “bad actors,” there are also a lot of bankers who are working hard to connect their clients to resources. And while Ruth’s Chris Steakhouse did secure a massive PPP loan, we’re also hearing about Shake Shack’s generous gesture of returning its PPP loan.

But to avoid the inequities in our system, we must consider equitable delivery systems that can ensure resources actually get into the hands of people that need it. As Congress convenes again to consider other initiatives for small businesses, local leaders have a role to play in ensuring that street vendors, mom and pop restaurants, and local manufacturers get access to these resources so we can survive enough to help us restart our economy.